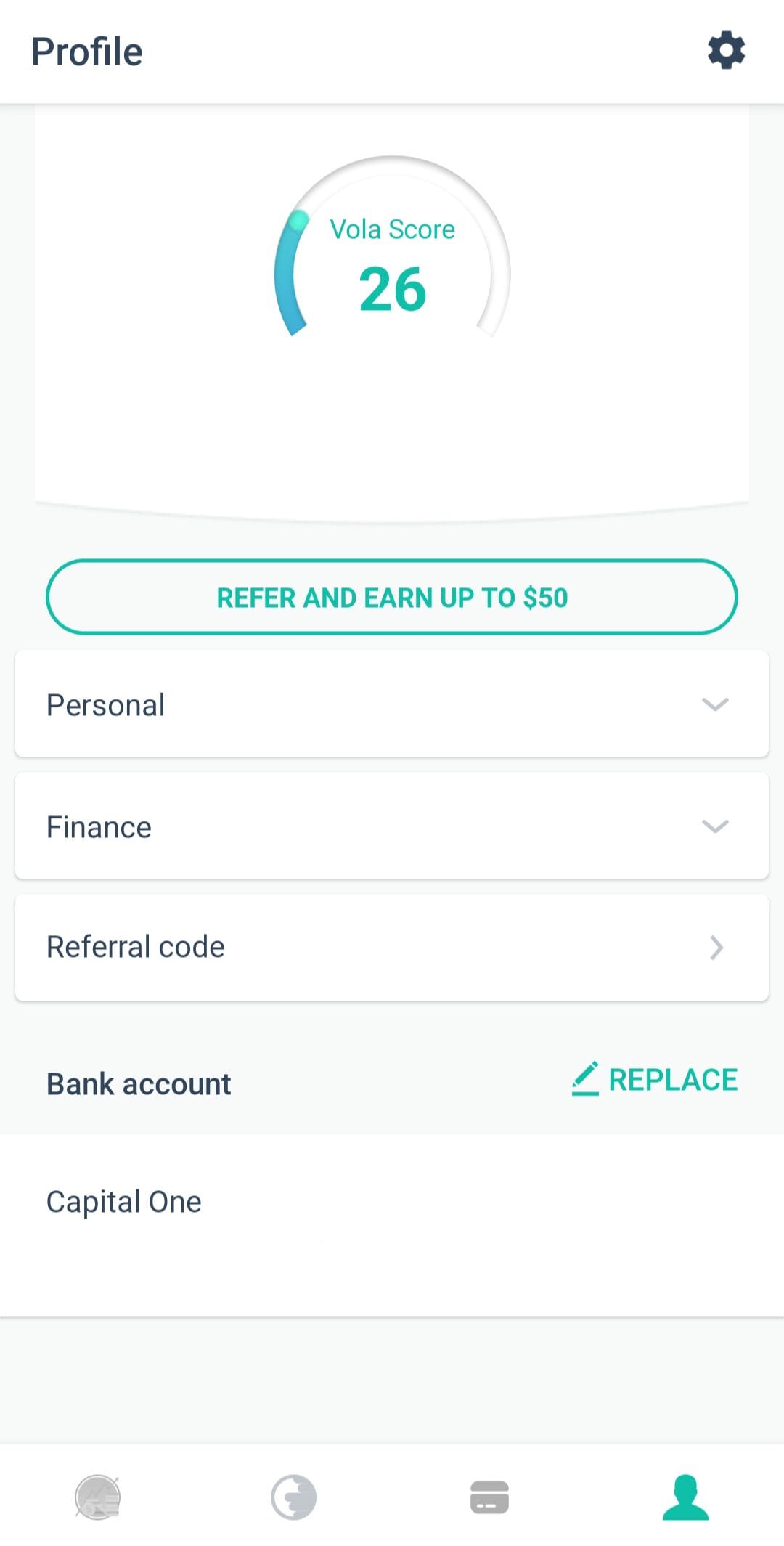

Vola Finance Invite Codes

App Store Rating

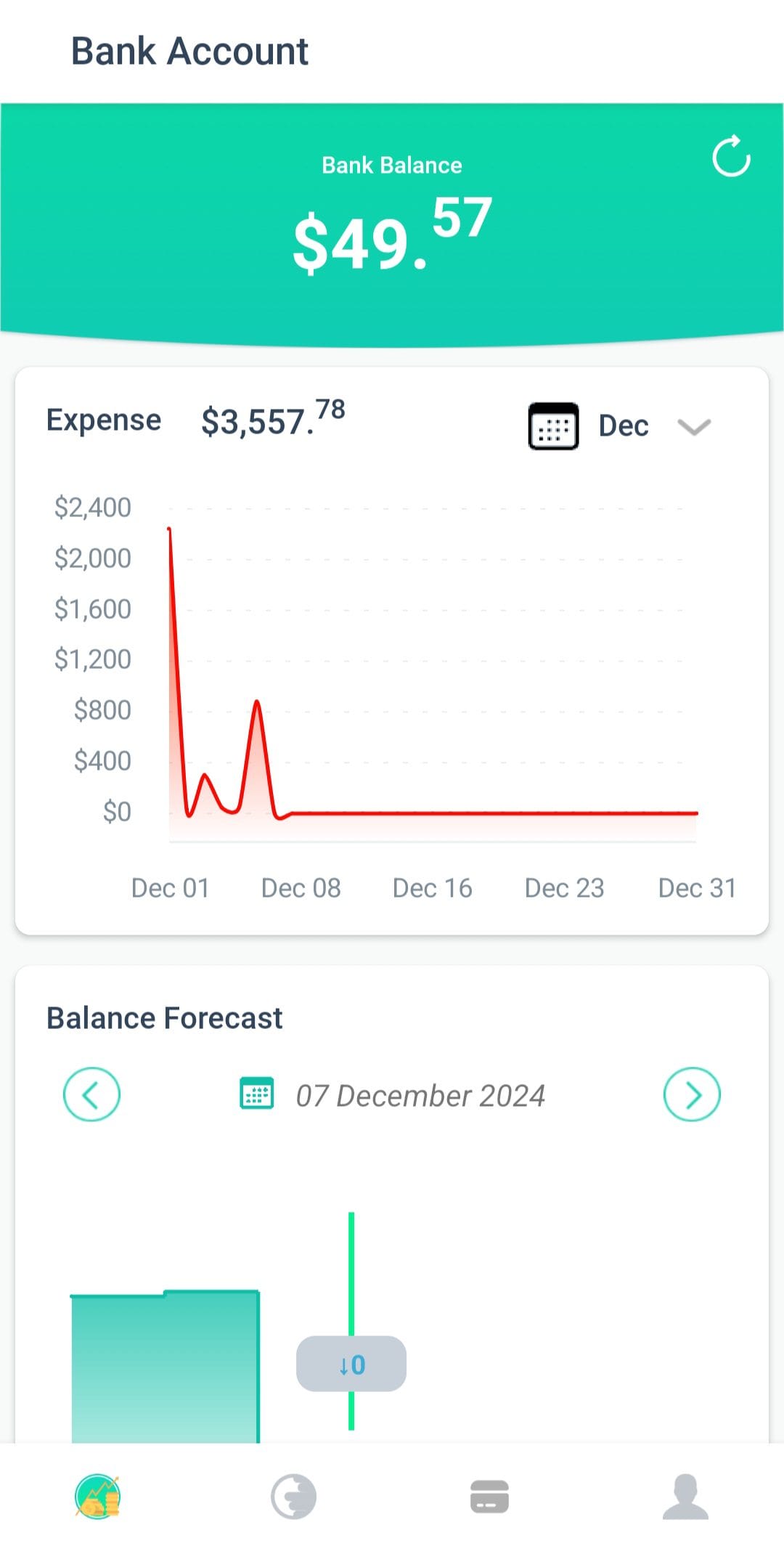

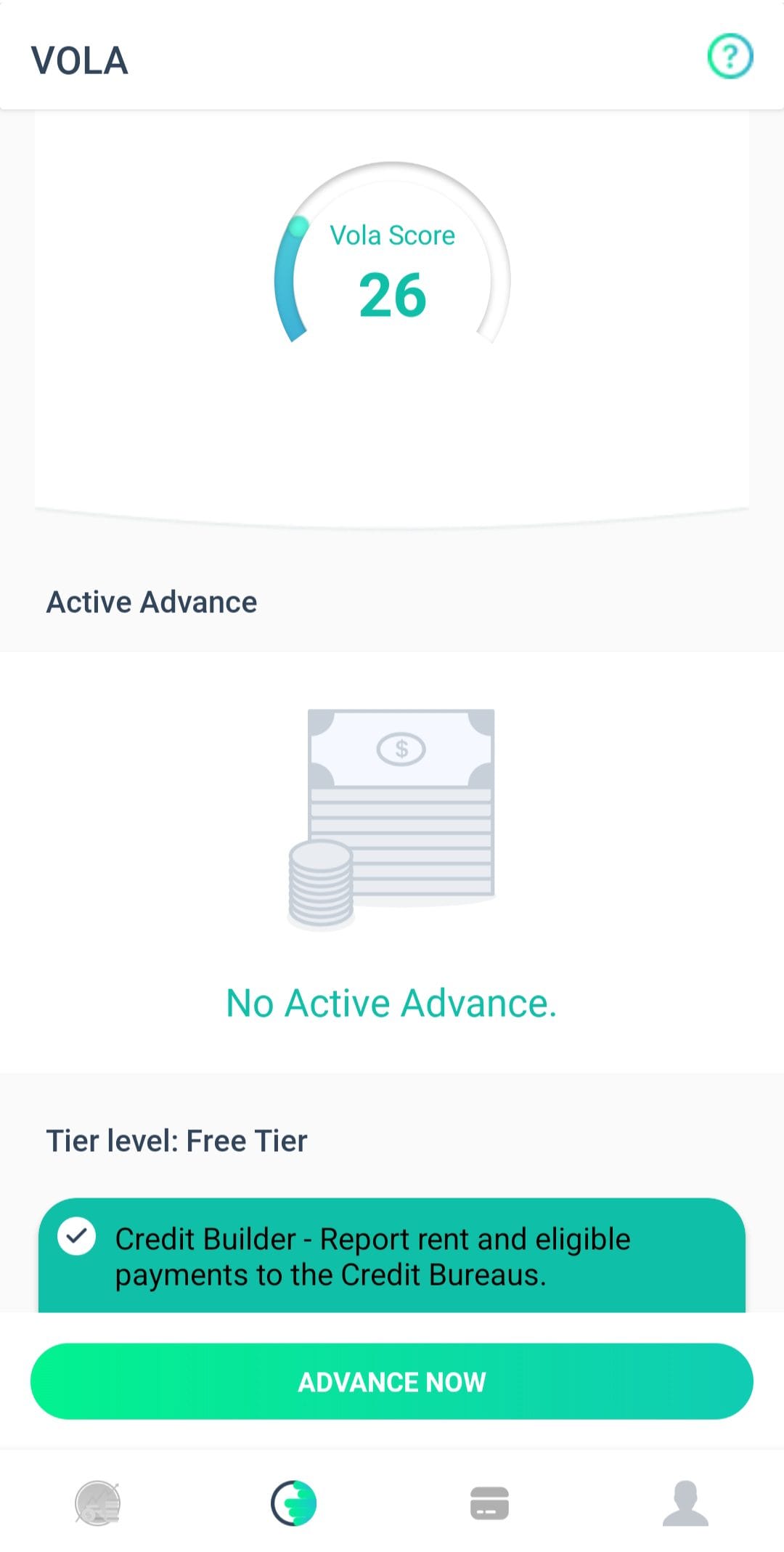

Vola offers cash advances to prevent overdrafts, enhancing credit score through smart savings strategies and allowing users to pay back advances, ensuring efficient financial management.

- Released: 2019

- Offered by: Vola Inc.

What EARNING opportunities does this app/website offer?

? Refer-A-Friend

Earnings Disclaimer: We can not guarantee that you will make any referral bonus income from using our website to post your referral codes and links.

? Bank Transfer

Confirmed Payout: No

Minimum to Redeem:

Bank Transfer – Rewarded amount.

Cashout Disclaimer: We can not guarantee that all the cashout methods and minimums mentioned above will be available to all users. Cashout methods available to you can depend on what country you live in and other additional factors.

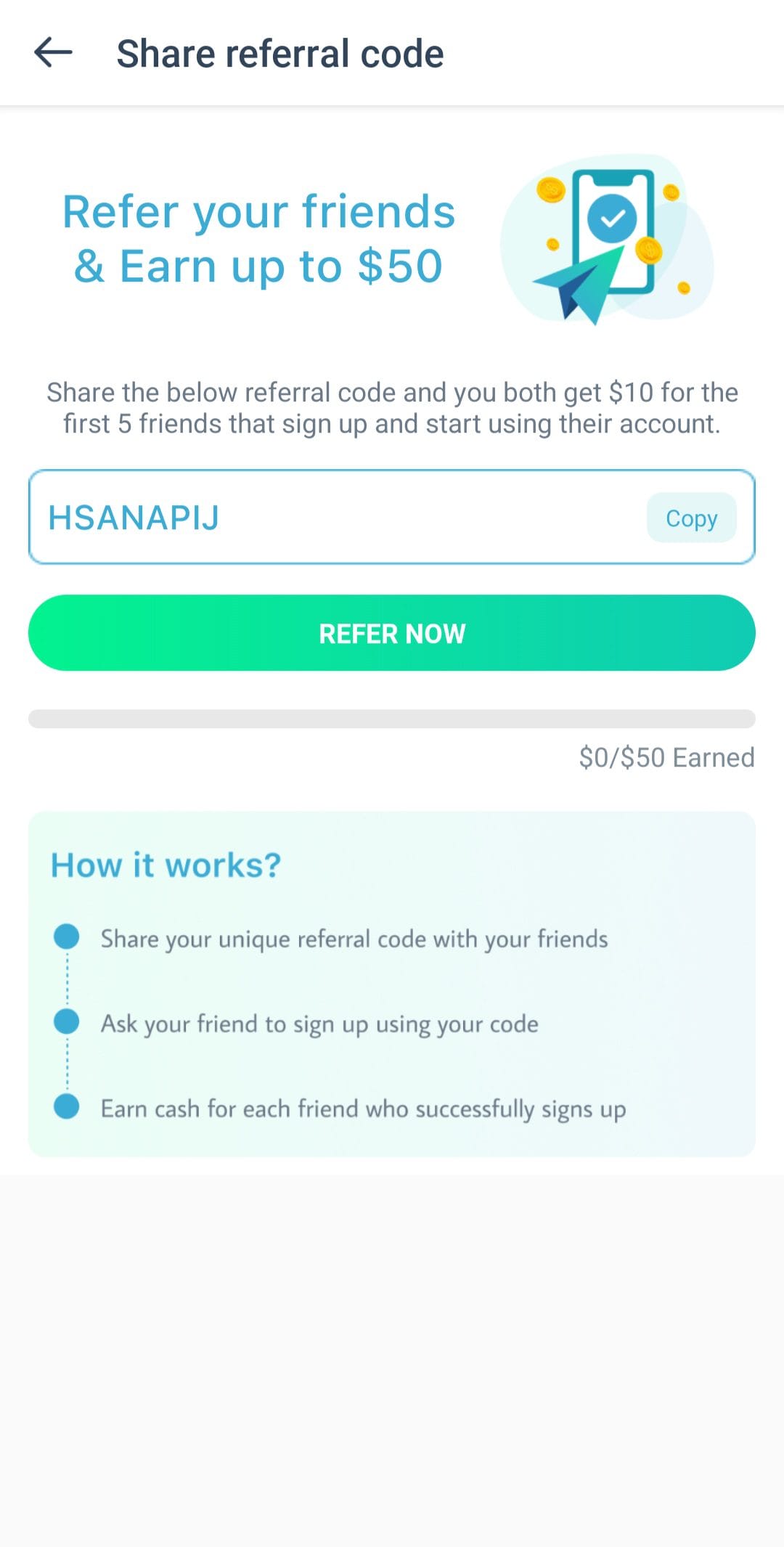

? Referral Bonus

Person Referred: Get $10 when you use your friends referral code or link to signup for a premium membership and start using your account.

For additional referral codes / links see User Submitted Referral Codes section below.

Problem with link or code? Contact Us.

Post your referral codes or links for free below. You must register and be logged in for the link to be valid to submit your code.

User Submitted Referral Codes

*Click to expand tabs to see referral codes.

Vola Finance Invite Code

? Hey, Your friend invited you to Vola. Vola can Advance you up to $400 based on your income, and help build your credit score. Get $10 directly to your bank by signing up. Click on the link below or manually enter the referral code in the app. *The reward is limited to the first 5 users referred. So sign up soon!

Check out the Vola Finance page for more information about the app and to add your referral code.

Table of Contents

Cash Back vs Points vs Miles 2026: Which Rewards Type Saves the Most?

Are you struggling to choose between cash back vs points vs miles in 2026? While 5% back or 60,000 points sound great in marketing, they are three different currencies with vastly different rules. In the era of AI-driven “Agentic Commerce,” the winner is the one that matches your actual spending habits and redemption effort.

The Three Currencies: Cash Back vs Points vs Miles 2026 Comparison

Before building your strategy, you must understand how each currency behaves in today’s market. In the debate of cash back vs points vs miles 2026, value is determined by stability and effort. According to recent data from NerdWallet’s 2026 credit card analysis, consumer preference is shifting toward flexible currencies that guard against inflation.

- Cash back: The most stable currency. Spend $100, get $2 back on a 2% card. It is simple, predictable, and requires zero effort to redeem.

- Flexible Points: A versatile bank currency. You can redeem for statement credits or transfer to travel partners for higher value.

- Miles: Usually tied to an airline. While they offer the highest potential “cents per dollar” for luxury travel, they are volatile and subject to award availability.

The Real-World Math of Cash Back vs Points vs Miles in 2026

The only clean way to compare cash back vs points vs miles 2026 offers is to convert them into a single metric: effective return percentage.

If your travel card earns 3X points and you redeem at 1.5 cents per point, your effective return is 4.5%. However, if you redeem for cash at 1 cent per point, that same card only gives you a 3% return. This variability is why points and miles cards require more “babysitting” than cash-back cards, a factor highlighted in the Forbes Advisor 2026 Rewards Report.

Category-by-Category: Who Wins the 2026 Rewards Battle?

Based on typical U.S. household spending in 2026, here is how the different rewards types stack up across major categories.

| Spend Category | Cash Back (%) | Points/Miles | 2026 Winner |

|---|---|---|---|

| Groceries | 3% to 6% | 1X to 2X | Cash Back |

| Dining | 3% to 5% | 3X to 4X | Points |

| Gas | 3% to 4% | Often 1X | Cash Back |

| Airfare/Hotels | 1% to 2% | 3X to 5X | Miles |

Why Cash Back Wins for Most Households

For the median person, cash back is the highest real-world saver. It eliminates the risk of points devaluing or expiring. Simple rewards get used, whereas miles often sit unused. For travelers seeking high-value airline redemptions, U.S. News & World Report consistently ranks Alaska Airlines and American Airlines as top picks for 2026 for those who do choose the miles route.

Using referral bonuses on cash-back cards is a powerful way to stack extra dollar-for-dollar value without the complexity of travel portals.

Conclusion: Cash Back vs Points vs Miles 2026 Decision Checklist

To finalize your cash back vs points vs miles 2026 strategy, ask yourself these three questions:

- Simplicity: Do you want your rewards to be automatic? Choose Cash Back.

- Luxury: Do you want to fly Business Class for “free”? Choose Miles.

- Flexibility: Do you want to decide later? Choose Points.

For most, a “Hybrid Wallet”—one flat-rate cash card and one high-multiplier travel card—is the best way to win. Ready to find the highest-paying offers? Visit Promo-Trader to access tested referral programs and confirmed cashouts today.

Dragoin Referral Code

? Join the Dragoin Adventure Today! Dive into Dragoin’s Telegram game! Earn $DDGN tokens while guiding your dragon through challenges. Join our community-driven crypto revolution now!

*Crypto Risk Disclaimer: Cryptocurrencies are highly volatile and involve significant risk. The information provided by this platform does not constitute investment, financial, trading, or legal advice. We do not make any guarantees regarding the accuracy, timeliness, or completeness of any content provided. By using this platform, you acknowledge that you are solely responsible for your decisions and investments. You should carefully consider your financial situation and consult with a licensed financial advisor before engaging in any cryptocurrency activity. We are not a registered broker-dealer or investment advisor and do not provide any form of fiduciary service.

Check out the Dragoin page for more information about the app and to add your referral code.

Table of Contents

Table of Contents

Submit your review | |